If you’re already able to save $500 every month, congratulations! You’ve achieved another milestone, and now you should consider whether to invest in ETFs like VOO or QQQ, making your $500 grow bigger.

The purpose of doing this is simple: to make your money grow steadily, even reaching your first $100,000 within ten years, just like with VOO.

You might doubt, “Is it really possible?”

So, to help you truly achieve your goal, I’ll break down the time needed step by step. Additionally, I’ll explain the risks involved and what practical steps you need to take along the way.

Of course, I’ll also share what I would do to give you a clearer picture.

Let’s get started!

How to Determine the Rate of Return for QQQ?

Let’s first list out the latest returns for various periods (extracted from the QQQ official website, statistics up to February 29, 2024):

| Year-to-Date | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception from 1999 |

| 7.20% | 50.57% | 12.51% | 21.27% | 18.12% | 9.70% |

Here, we use the return rate since inception in 1999 because the long-term return is less likely to be influenced by short-term fluctuations, thus minimizing significant discrepancies.

When estimating, I’ll also use the 9.70% return rate.

How much will the cumulative amount be after investing?

Here, we assume you start from scratch and make an investment only once at the beginning of each alternate year. The results will be as follows:

| Years | Accumulated Costs | Accumulated Value |

| 1 | 0 | 0 |

| 2 | 6,000 | 6,582 |

| 3 | 12,000 | 13,802 |

| 4 | 18,000 | 21,723 |

| 5 | 24,000 | 30,412 |

| 6 | 30,000 | 39,944 |

| 7 | 36,000 | 50,401 |

| 8 | 42,000 | 61,872 |

| 9 | 48,000 | 74,456 |

| 10 | 54,000 | 88,260 |

| 11 | 60,000 | 103,403 |

Based on the calculations from the previous chart, if everything goes smoothly, you can successfully achieve this goal by the 11th year. It’s just one year later than the original target.

Is it really that smooth sailing? Plus, there are these uncertain factors you must consider.

Is it really that smooth sailing to achieve the goal by the 11th year?

It’s not impossible, but it relies on having a 9.7% return rate every year for QQQ. However, in reality, there are several uncertain factors you must consider:

You may encounter sudden stock market crashes or corrections.

The first uncertainty is not knowing when a significant correction or even a stock market crash might occur.

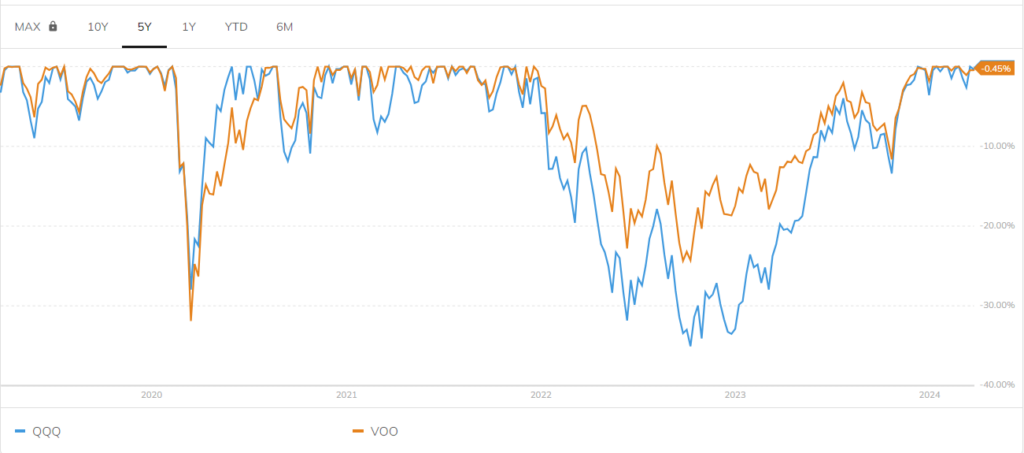

If you recall, the violent interest rate hikes by the Federal Reserve in 2022 led to a drastic drop in QQQ by over 30% from its peak throughout the entire year, surpassing VOO’s 24% decline, as shown in the maximum drawdown comparison table below (extracted from PortfolioLab):

Likewise, such significant downturns or corrections of approximately 10% can happen unexpectedly on QQQ, and you won’t know exactly when.

Even if you, like many professional managers or analysts, understand how to judge market movements based on fundamentals, technicals, and fund flows, the ultimate outcome often deviates drastically from your expectations, leaving you slapped by the market.

If you are unfortunate enough to encounter such situations, all you can do is patiently wait it out.

The volatility is too high, and your heart can’t handle it, leading to automatic exit.

Another uncertainty is that the volatility of QQQ may shake you out!

QQQ mainly focuses on tech stocks with higher volatility, such as Apple, Microsoft, Nvidia, Amazon, and so on, making its volatility greater than other broad market ETFs.

You can easily imagine a scenario where your QQQ holdings suddenly surge by 5% one day, only to be wiped out to break even near the closing, or even drop by 10% the next day, followed by an 11% surge the day after. With such dramatic ups and downs, many unprepared or untrained individuals, I believe, would be scared for several days, unable to sleep well.

You think it’s exaggerated? It’s not. If interested, you can research the situation in early March 2020. I won’t elaborate further here.

Weak impulse control, wanting everything.

The third uncertainty is your weak impulse control, wanting to invest in every stock, not just QQQ only.

If you often watch the news or browse through platforms like Raddit, IG or Tic Tok, almost every post discusses trending stocks. Some even buy every stocks on trending, claiming they want to maximize their profit. Even your friends and family may be talking about buying them.

If you’re influenced by all this, congratulations, you’re delaying your goal of reaching $100K. What was initially set for 11 years might extend to 15 years (just assuming).

Unexpected cash flow interruption catches you off guard.

Finally, an unforeseen interruption in cash flow is another risk you should be aware of.

You might suddenly encounter a car accident, leaving you unable to work for several months, or you might need to help someone financially with a significant sum of money. Alternatively, you might unfortunately face a layoff, resulting in the loss of your original salary and relying on savings to get by.

These unforeseen circumstances (though many of them can be avoided) can interrupt the funds available for investment, thus delaying the timeline to reach your $100,000 savings goal.

To achieve success, you must do the following:

Seeing so many uncertain factors on your way to invest QQQ, you might start losing confidence and seriously doubt whether you can really achieve the goal of $100K.

Don’t worry! As long as you do these few things well, you can almost certainly achieve it:

Continuous investment without distraction

Firstly, please focus on investing in QQQ and refrain from constantly thinking about buying everything.

As mentioned earlier, when you try to buy a little bit of every stock or ETF, your holdings become too diversified, and many of them may not perform as well as you expect. In fact, this diversification can drag down your performance, leading to an extension of the timeline originally set for achieving your goal.

Therefore, once you start investing in QQQ, refrain from thinking about buying other stocks. If you really have the urge to buy something else, limit yourself to selecting just one stock at most, and avoid investing too much capital. After all, your main battlefield remains in QQQ.

Reinvesting dividends

Next, please continue to reinvest the dividends you receive instead of spending them.

Although the dividends distributed by QQQ are minimal, barely reaching 1%, and subject to a 30% tax deduction, don’t underestimate these small dividends. By reinvesting them, they remain a part of your assets and can significantly contribute to the growth of your portfolio through stock price appreciation.

Often, wealth is accumulated through the compounding of these small amounts of money.

Extend the investment period and leave some flexibility

The third point is to extend your investment horizon.

As mentioned earlier, you cannot predict whether the future will bring gains or losses, or even if there will be a market crash. Additionally, you may not know when you’ll suddenly need money or if you’ll face unexpected job loss.

Faced with various uncertainties, the best approach is not to rigidly adhere to achieving your goals within a specific number of years. Instead, consider extending your investment timeline to 10 or 20 years (perhaps it seems too long?), allowing yourself more flexibility. This way, you can execute your plans with greater ease and success.

Have a little more confidence

Lastly, please give yourself more confidence.

I know many people constantly doubt whether they can achieve their goals in the early or even mid stages of investing. Sometimes, encountering sudden corrections of around 5% to 10% can be alarming, causing individuals to hesitate to continue investing.

This is entirely normal. Even after investing for so long, I still have these thoughts.

Therefore, please remind yourself from time to time that you are already on the path to your ideal future. One day, you will surely achieve your goals. There’s no need to give up now because “if you give up now, the game is over.”

If it were me, I would do this…

However, after all that discussion, I’m afraid you still might not fully grasp it, so let me tell you how I would approach it!

Firstly, I would find a brokerage firm to set up regular automatic contributions. Once I’ve configured the app, I’ll ensure there’s enough money available each month to be deducted.

Next, I’d delete all the financial news channels, influencers, and discussions I used to follow. When friends and family want to talk about it, I’ll just play along, ensuring they don’t affect my plans.

Mentally, I’d ease up on the pressure, not fixating on achieving the goal within a specific timeframe. Just focusing on consistent actions will eventually get me there.

Moreover, whenever there’s a bonus payout, I’ll increase my investment amount to expedite reaching the goal.

Lastly, I’ll concentrate on work, continuously improving myself, and seeking opportunities for higher income to increase my investment capacity. I’d aim to live well without letting this pursuit bind me and disturb my life.

Why not give it a try yourself?