Have you ever considered that you could rely on the dividends from VOO and QQQ to sustain your livelihood, just like with high dividend ETFs or the US treasuries?

In fact, this is also a feasible approach, where you can earn dividends and benefit from price differentials, so why not give it a try?

Of course, this will also be a way for me to ensure stable cash flow after retirement.

However, if you also want to follow in my footsteps and use the dividends from VOO and QQQ as one of your sources of cash flow, there are four points you must pay special attention to, to avoid disappointment.

Let’s get started!

VOO and QQQ has very low yieldd

Firstly, the first point is that the dividend yield of VOO and QQQ is very, very low.

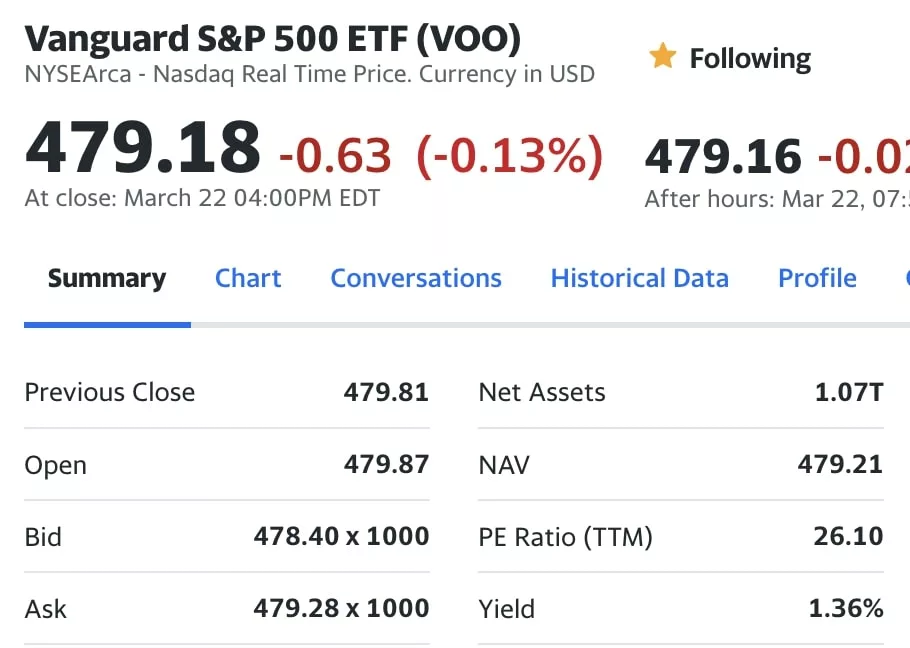

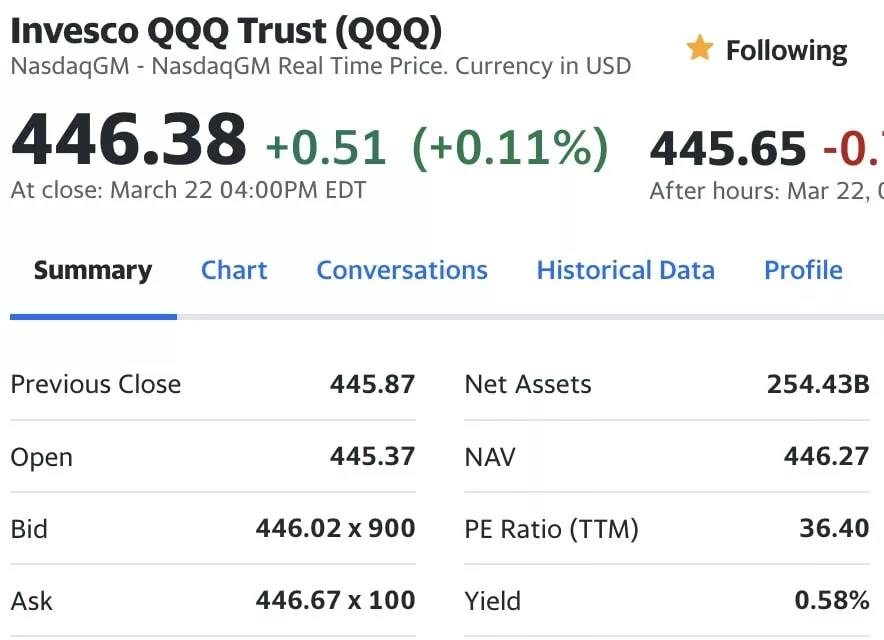

Based on recent data from Yahoo!Finance, the dividend yields of VOO and QQQ are only 1.36% and 0.58% respectively (see below yield field), just slightly better than a savings deposit:

Given how low this is, you might think it’s better to buy other high yield ETFs or stock instead, even Treasuries are mush better than them.

However, investors in these two ETFs are primarily focused on the future growth of stock prices rather than the dividends themselves, because for such low dividend yields, it’s actually reasonable.

Your invest amount must big enough

Next, because the dividend yields of both ETFs are indeed very low, if you want to receive more dividends, you’ll inevitably need to increase your investment amount.

Based on the current dividend yields, suppose you want to receive $50000 in dividends annually, then you would need to invest nearly $3.67 million in VOO or around $8.62 million in QQQ to achieve that.

(And we haven’t even mentioned the issue of taxes, which we’ll discuss later.)

Just seeing the amount of investment required, I believe many people would exclaim “Impossible!”

However, if you start investing earlier, there’s still a chance you can accumulate that much money!

The exchange issue for non-US residents

The third point is about the issue of currency exchange rates, especially for non-US residents.

VOO and QQQ are priced in US dollars, and transactions are also conducted in US dollars. Therefore, dividends are naturally paid in US dollars as well.

For non-US residents, when receiving dividends, they need to be converted from US dollars to Euro, Taiwanese dollars, Japanese Yen, or other currencies, depending on the exchange rate between the US dollar and these currencies at that time.

Take Taiwanese Dollars as example, during the period from 2022 to 2024, the exchange rate between the US dollar and the Taiwanese dollar fluctuated between approximately 30 to 32 Taiwanese dollars. Therefore, the dividends you received during this period would be relatively favorable.

However, between 2020 and 2022, there was a period when the exchange rate fluctuated between 27 to 29 Taiwanese dollars. If you received dividends during this period, it would not have been as advantageous.

Therefore, you cannot directly calculate how much dividend you will receive using a fixed exchange rate because exchange rates are easily influenced by international economic and political factors, resulting in unstable fluctuations.

However, if you choose to automatically reinvest dividends, you won’t be affected by exchange rate fluctuations.

It will be deducted 30% before distribution

The final point, and perhaps the most painful aspect for many dividend recipients, is the withholding tax of 30%.

Typically, when dividends are issued, brokerage firms will deduct 30% of the tax before transferring the money to your account.

For example, if you expect to receive a dividend of $100 USD, you will only see $70 deposited into your account, with the missing $30 being the portion that must be remitted to the US Treasury.

For non-US residents, you could also choose to apply for a tax refund from the Internal Revenue Service (IRS) in the United States. However, if your withholding tax amount is significant and you are not familiar with the US tax system or do not have specialized accountants to assist you, I do not recommend doing this directly.

Conclusion

If you intend to rely on VOO and QQQ to earn dividends, you must understand that the dividend yields of these two ETFs are very low, only slightly better than savings account interest rates. Additionally, the fluctuations in exchange rates and the issue of withholding taxes are different from each country, especially for non-US residents. To increase the dividends you actually receive, the solution is to increase the amount you invest or to continue reinvesting dividends, which will allow you to receive more dividends in the future.